Ever since Satoshi Nakamoto created Bitcoin 12 years ago in 2009, it has had many ups and downs, as well as many setbacks and gains. Over time, it has gotten more advantages, like Segwit. Many of the bugs inside the Bitcoin network have also been fixed. It has adapted itself to the digital world with which it has connected to. One of these updates that have made security changes and increased privacy in the Bitcoin network is Taproot. Let’s explore the definition of taproot signaling in bitcoin, and how that’s going.

What is Taproot?

Before you can understand the signaling process, first you need to understand its history.

As you know, one of the most important reasons for the popularity of Bitcoin’s core development team is their use of special security as well as privacy. Not too long ago, bitcoin developers were discussing the Taproot upgrade. It includes Schnorr signatures that will make changes in scripts, particularly in security and anonymity as well as its privacy. If you search carefully on bitcoin block explorers, which index addresses and transactions publicly, you can monitor some activities. Therefore this is one of the important concerns for the bitcoin network.

For these concerns, mixing services and CoinJoin solutions can increase anonymity in the blockchain. But a solution inside the source code was required. Greg Maxwell made the Taproot proposal in 2018 as a result. It officially launched in October 2020 when Bitcoin Core developers merged it on Github. It includes Schnorr, which combines signatures together into one. This makes it harder for others to trace your transactions It also makes transaction fees smaller. In fact, Taproot provides a way to make complicated transactions and smart contracts.

It also introduces a new address format starting with “bc1p”, which stands for an address that supports Taproot. Other than that, the addresses and transactions look nearly identical to their older versions.

Taproot will reduce the amount of storage space on the network by up to 20% by aggregating Schnorr signatures. With smaller transactions, nodes can process more of them every second (one of the best ways to increase the speed of the network). The fee for each of these transactions will be pretty low.

Now, on to the taproot signaling definition.

How much of the network is signaling for Taproot?

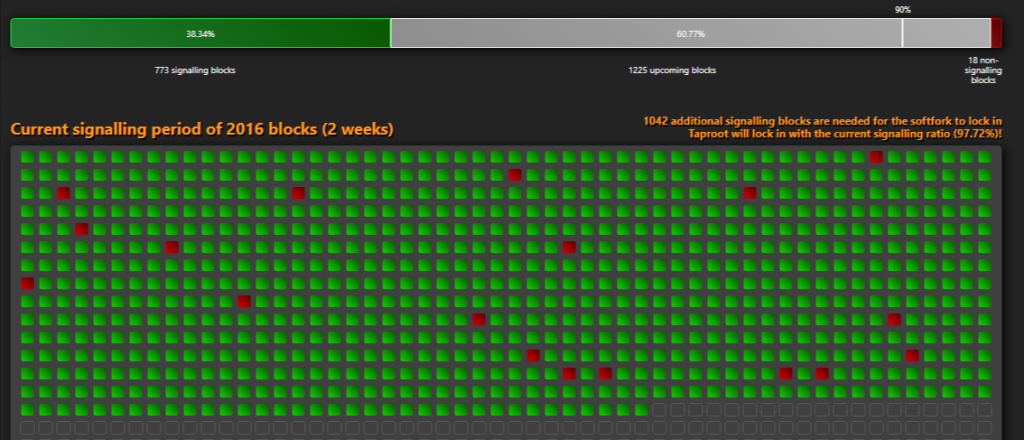

Many miners have signaled support for this update and only a small percentage of them remain. Others are not supporting it for reasons we don’t know. Right now, there are 773 signaling blocks (38.34%) in the bitcoin network, 1225 upcoming blocks, and a record low 18 blocks which have not signaled for taproot. You can see the statistics live on the Taproot Watch website.

Which pools have signaled for Taproot?

Here is an incomplete list of mining pools which have signaled support for taproot in their blocks:

- Antpool

- Poolin

- F2Pool

- btc.com

- Binance Pool

- Viabtc

- Foundry USA

- Houbi Pool

- Spiderpool

The odds of the Taproot signaling succeeding

At least 1815 of the 2016 blocks need to signal, or 90%. If this does not happen in time, the period will be transferred to the next 2016 blocks.

However, If 90% of the blocks have signaled for Taproot during this period, the full nodes must upgrade their bitcoin core software to a newer version to use the new features.

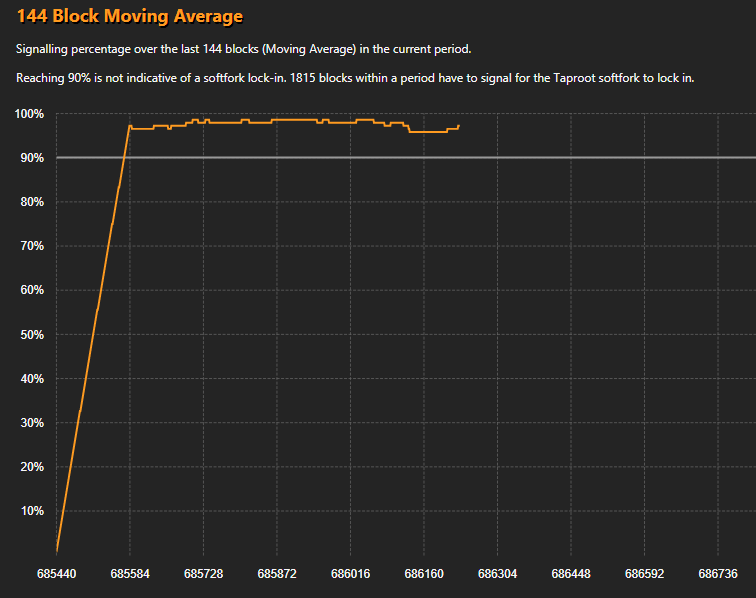

The percentage of blocks signaling for activation is increasing every day. Here is an image that shows how many of the last 144 blocks are signaling for it:

Given the large support by the miners, the majority of the bitcoin community supports this design. As a result, Taproot should activate within a few weeks. It will not take a long time to reach 90% support from the blocks in this period.

This network update will make payments safer and less expensive than before and will keep Bitcoin as a popular cryptocurrency. These developments and network improvements, in the long run, will increase the number of companies and organizations entering the Bitcoin network. There is also a possibility that the price of bitcoin will increase.

I hope this article helped you know the definition of Taproot signaling as well as taught you new information about Bitcoin Taproot signaling.