There are many restrictions on the power consumption of bitcoin mining that force miners to turn off their devices. Bitcoin has been around since its inception as the first digital currency, and miners have been around since. Bitcoin mining will continue until and beyond the last bitcoin. But what has made bitcoin mining difficult in China’s Sichuan region?

Will Sichuan seize all the mining rigs?

In this article, we will examine the situation of bitcoin in China’s Sichuan region. How does Sichuan rank in digital currency extraction?

Sichuan and Inner Mongolia are the second-largest digital currency mining regions in China, with Sichuan dependent on clean and hydropower. Xinjiang also supplies coal with extraction energy and has 36 percent of the global hash rate.

Energy executives in southwest Sichuan convened a meeting to discuss bitcoin power consumption and implement new policies for digital currencies. Due to the increasing power consumption of Bitcoin as well as the arrival of the summer season, miners must agree with the decisions made in the Sichuan region. so decided that by September 2021, all miners should leave the area to manage electricity consumption in the province.

Why did they make this decision?

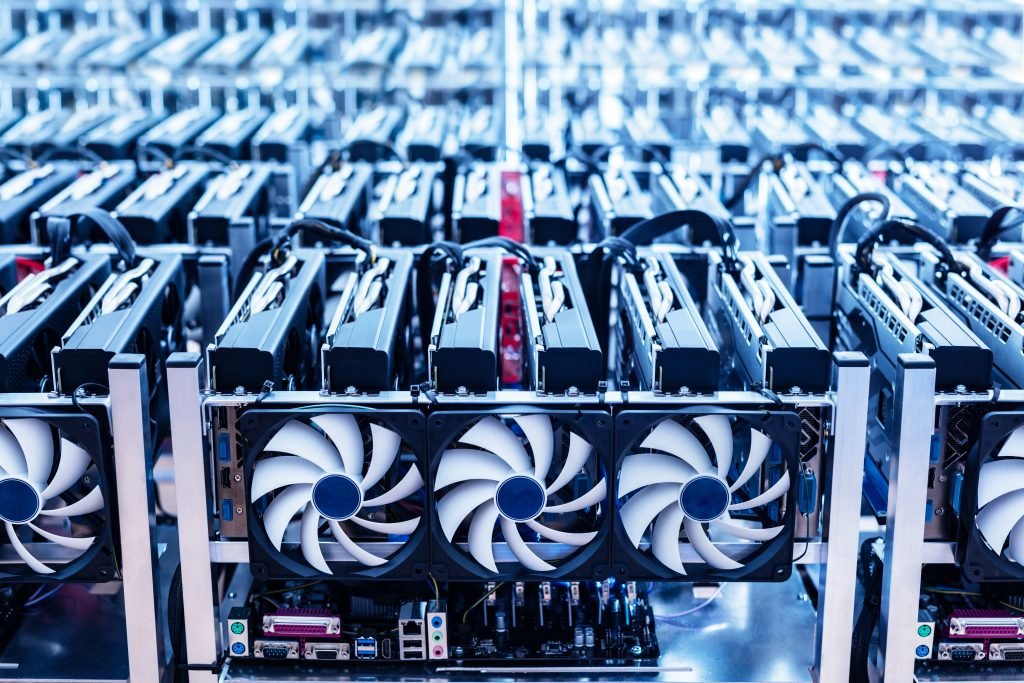

Due to the high power consumption of miners and the reduction of network power, and also the reduction of bitcoin network power for mining, miners must operate with more power and with more numbers. China is one of the countries of the bitcoin mining pole and an important country in mining digital currencies.

One of China’s recent policies is to crack down on bitcoin mining in the region, which could result in a reduction in the strength of the bitcoin mining network and the inefficiency of mining digital currencies at the cost of electricity after migrating to other locations.

One of the strategies of Chinese miners was to take mining machines out of the country and set them up in a third country, such as Iran, where they can mine digital currencies using cheaper electricity. But this is now out of the question after Iran banned cryptocurrency mining last month.

Another reason for this decision could be the increase in air pollution in the region. Due to the pollution caused by bitcoin mining with increasing power consumption, miners in Sichuan have turned to hydropower dams. The result was an increase in the number of miners in the province, resulting in a temporary power outage.

What will happen to the Sichuan miners?

Sichuan is one of the largest mining centers in the world. During meetings in Sichuan in recent weeks, it was decided that miners should leave the area by September. But it could give miners a chance to take advantage of excess hydropower over the summer. Some people say that Sichuan has enough clean energy to mine bitcoins, and this has caused controversy among people.

But how much does electricity consumption increase in summer? Rising temperatures in the summer can damage bitcoin farms and miners. Creating proper ventilation conditions and multiple fans can increase the heat in 30% of electricity consumption.

Sichuan and other bitcoin mining areas are to face more power problems in the summer. However, it remains to be seen what will happen by September. Given the power consumption of miners, it is estimated that the global bitcoin network consumes as much energy as the Netherlands. Does the Chinese government prefer its environmental and energy policies to bitcoin mining?