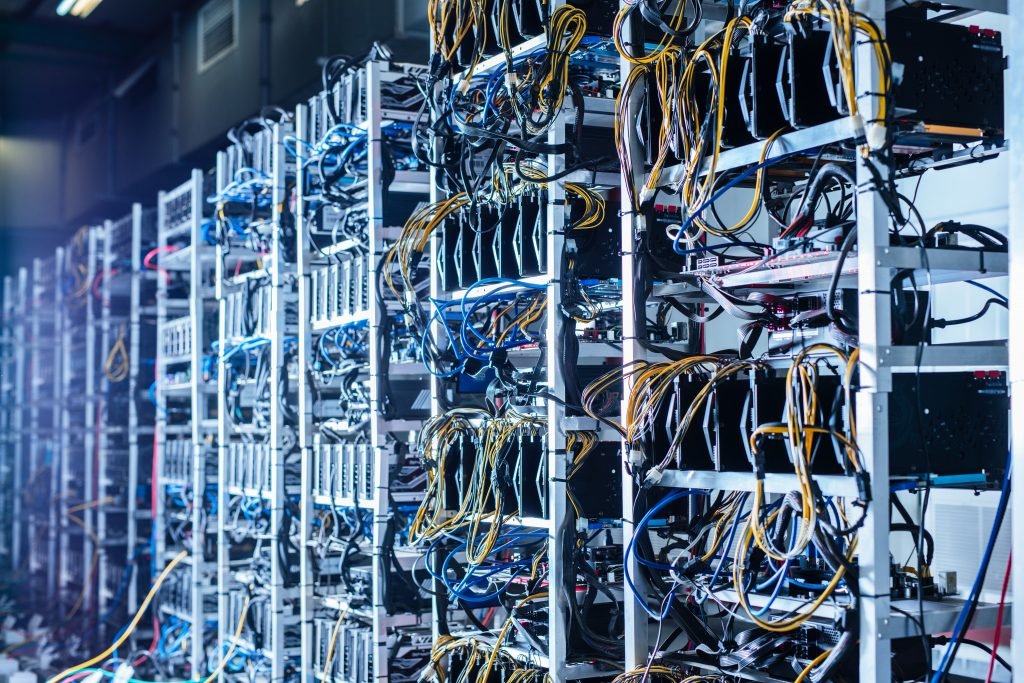

Miner power consumption is one of the problems that is becoming more apparent over time, and most countries and digital currency mining farms are concerned about it. But there is another problem in extracting digital currencies, one of which is air pollution due to the use of industrial electricity. This problem has led to many opinions about how bitcoins are mined and their impact on our world. As a result, many solutions have been devised by governments, one of which is to work with other countries to mine digital currencies. At one of China’s provinces, Sichuan will restrict China’s bitcoin mining from September. As a result, cooperation between China’s bitcoin mining and Iran has taken place, which we will discuss in the following article.

In a previous article, Sichuan had problems with bitcoin farms consuming electricity and ordered miners to stop bitcoin mining in Sichuan. This has happened in many other cities and countries as well. Heat levels in the summer become more sensitive to power grid control. As a result of the use of industrial applications in the summer, miners also face a 30% increase in electricity.

What is the reason for the increase in electricity consumption in summer?

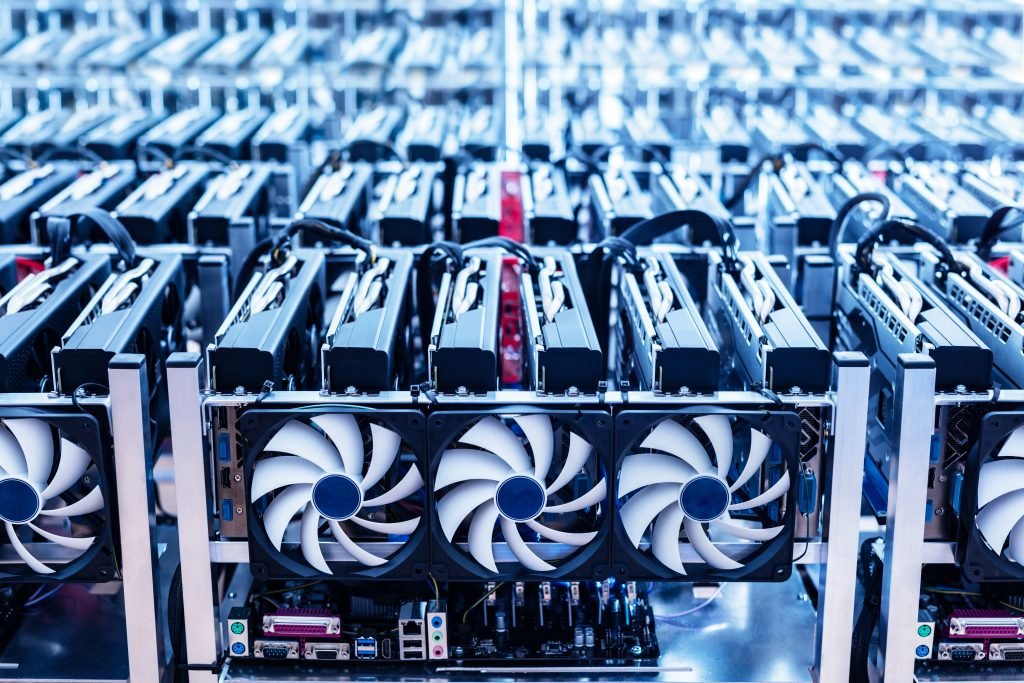

Miners are sensitive to temperature changes and the temperature of the farm environment should always be within a standard range. Creating dry and cool conditions reduces the miners to have better activity and longer useful life. As a result, they should increase the number of fans in the hot season. This is one of the reasons for the increase of 30% of electricity consumption in the hot season by miners. Creating such conditions along with consuming 113.89 TW/h of bitcoin per year, governments were forced to create new, hostile policies!

China-Iran cooperation in mining digital currencies

At first, perhaps few thought that the bitcoin mining industry would expand from 2009 to the present, forcing companies to engage in large-scale partnerships and multimillion-dollar bitcoin mining contracts. Bitcoin has proven itself in the world and created an important network in people’s lives. A Chinese company has signed a contract with one of its partners in Iran to build a farm with a capacity of 1.2 exahashes and invested $ 300 million in various phases of construction. The establishment of such a farm in Iran has been done with the aim of cooperation and reducing electricity costs.

Of course, it goes without saying not to abuse your electricity sources if you want to stay in business. The above-mentioned plant lied to the press about building a data center with “1.2 million terabytes” capacity and was subsequently shut down by Iranian authorities last month when its input power became a major cause for nationwide power outages, after posting a video of the mining farm on Youtube. Other mining farms are reported to be operational at the time of this writing.

Rafsanjan, a city where Chinese miners work!

Rafsanjan uses industrial electricity sources and is a good option for placing Chinese miners there. This farm operates in Iran by fulfilling all legal and permitted conditions and using cheap electricity in the region. They can extract digital currencies at a lower cost.

Details of extraction farm in Rafsanjan

This farm consumes 60,000 MW of electricity per month and according to the reports of the Ministry of Energy of Iran, the electricity consumption of this farm is 10 times the industrial consumption. This farm consumes about 0.4% of the total electricity of the country. Due to electricity costs, the farm experienced a four-month blackout and then resumed operations. The reason for this was to save bitcoin mining as well as increase electricity tariffs in those four months.

The largest bitcoin mining center in Iran?

The company has established the largest bitcoin mining farm in Iran in Rafsanjan. Also, according to reports, Iran is one of the leading countries in extracting digital currencies.

What is the cause of this problem?

In fact, Iran is self-sufficient in electricity generation with its abundant oil and gas resources, as well as the use of industrial power plants, and cheap electricity and gas are supplied to Iran and is one of the favorable conditions for extracting digital currencies. It can both use lower electricity tariffs and not experience bitcoin environmental congestion in its own country.

A few months ago, Tesla announced that it would no longer accept bitcoin as a way to trade its vehicles, given the environmental problems caused by bitcoin as well as its extraction problems. But in a new tweet, Elon Musk announced that if Bitcoin uses renewable and clean sources for mining, we can see the company re-trade with Bitcoin. the Chinese, in contract with Iran and mining in this country, they’re able to remove the pollution caused by mining.

Finally, we can conclude that the extraction of digital currencies has become one of the most lucrative industries for companies, and this cooperation can show the importance of bitcoin in the future. In any case, bitcoin mining will continue until the last bitcoin. The country that has mined the most bitcoins today; In the next generations, it will become one of the most successful countries in the digital world.