What are Stablecoins?

Stablecoins are a form of cryptocurrency that creates greater market stability for investors. The reason for such stability is because it is backed by assets like the U.S dollar. This feature distinguishes Stablecoins from other digital currencies such as Bitcoin, which is not dependent on a stable asset; It distinguishes. Reasons for the popularity of Stablecoins include:

- Instant processing

- Privacy

- Low oscillation

- Security

- And..

Resources Supported By Stablecoin?

Stablecoin is backed by multiple sources such as fiat currency, precious metals, and algorithmic functions, and other cryptocurrencies. For example, when Stablecoin is backed by fiat currency, it is connected to a centralized financial system, thereby making it more stable. This is because there is a controlling and credible authority (such as the central bank). That can keep prices from fluctuating sharply. So Stablecoin is trying to bridge the gap between fiat currencies with cryptocurrencies and act as a bridge.

Categories of Stablecoins

Crypto-Collateralized

These types of stablecoins are backed by other cryptocurrencies. But due to the fact that cryptocurrencies fluctuate sharply, this type of stablecoins has used another solution. In this solution, more cryptocurrencies are maintained as a reserve to issue fewer stablecoins. For example $ 1,000 ETH is possible for reserves for issuing $ 1,000 stablecoins.

Fiat-Collateralized (IOU)

Fiat-collateralized stablecoins Fiat currency storage, like the US dollar, is stored as collateral to issue a good number of crypto coins. Other types are collateral, such as gold or silver, etc. But you should know that most stablecoins use the US dollar reserves. An example of this is Tether, which is worth $1.

Non-Collateralized (algorithmic)

These types of stablecoins are different from the previous two models of stablecoins and are more difficult to understand. In fact, these stablecoins do not use any reserves. But they use a mechanism (such as the central bank) that keeps their prices stable. The dollar-pegged basecoin uses the consensus mechanism. This mechanism reduces or increases the supply of tokens as needed. One of the most enduring is AMPL, whose makers say it is ready to deal with market shocks.

But why do we say (like the central bank)? Because this kind of mechanism works like printing money.

Why Are Stablecoins Important?

Stablecoins were originally using to buy cryptocurrencies such as Bitcoin and ETH. But today we see that these currencies are much more useful than the printed currencies in the country. With stablecoins, you can trade them at any time of the day or night, 7 days a week. All transactions are done in a few seconds, creating more security. They can also be converted back into the original currency. Stablecoins can also work by executing smart contracts on blockchains. No license is required to execute it. The codes in the software automatically specify the terms of the agreement and the time and type of money transfer and schedule stablecoins. Smart contracts cause stablecoins to be used in many cases, including trading, lending, insurance, prediction markets, etc and known as decentralized finance or DeFi.

Fast transactions

Stablecoins are trade faster and easier against Fiat currencies. It only takes a few steps to complete a person’s network transactions. It is so fast and secure that it is difficult to provide such conditions for Fiat currencies. This is one of the reasons why Stablecoins fans prefer it to Fiat currencies.

Will The Value Of Stablecoins Increase?

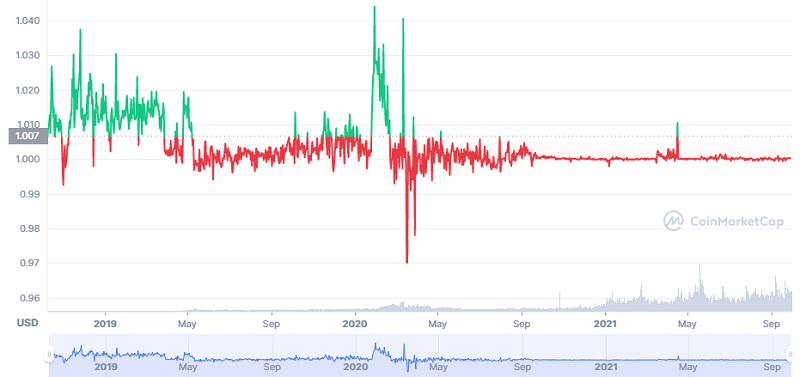

Stablecoins may fluctuate slightly but quickly return to their previous price, creating price stability. So no investment can use Stablecoins as an investment whose value increases over time. Let’s look at the USD chart:

As you can see, the USD has hardly risen above $ 1 during its presence in the market. But has quickly returned to the previous price. So Stablecoins can be store digitally as cash and are not worth the investment for high profits.

Best Stablecoins

- Tether

- USD Coin

- Binance USD

- Dai TrueUSD

- TerraUSD

- Pax Dollar

- Neutrino USD

- HUSD

- Fei Protocol

Buy Stablecoins

First, you need to open an account in exchange. There are many exchanges that you can see a list of the best in America here. After opening an account, you can buy stablecoins directly from your bank account or with other cryptocurrencies or other payment methods available in the exchange. After purchasing stablecoins, you can save it in an exchange or in your wallet (digital / hardware).

Concluding

Stablecoins create a safe environment for investors, from the security and fast transfer of transactions, to market stability and price retention. But they use new technology and you can not be 100% sure about them. But you can use stablecoins for your digital assets, But remember to never count on stablecoins to increase your capital. Because the main purpose of stablecoins is to maintain price stability, not to turn people’s capital into millions of dollars.