Even if you don’t know what is BRC-20, anybody who has the slightest understanding of Bitcoin probably knows that it exists on a blockchain. Obviously, a blockchain consists of blocks, and transactions need to be placed in a block so that they can become part of the blockchain.

Bitcoin’s blocks are about 1 megabyte large, on average. Sometimes, they might be larger than that. Combined with the fact that blocks are made every 10 minutes, this brought a peaceful harmony for some years, with a few exceptions.

Now, the equilibrium has been disrupted by the onset of swarms of transactions called BRC-20. The BRC-20 transactions don’t actually do anything useful and have even been described by their creator as worthless.

So? What’s the big deal? Who cares about BRC-20?

In theory, nobody should care about them. There have been several instances of putting altcoins onto Bitcoin’s network for many years, even meme coins onto the network, and nobody really paid attention to them. Examples of such protocols and technologies are Omni and Counterparty.

However, BRC-20 is different from Omni and Counterparty. It leverages a loophole newly added code from the Taproot upgrade, which has been first discovered by Casey Rodarmor, a bitcoin software engineer who invented the Ordinals client.

You’re confusing me! What are Ordinals?

A brief recap. Ordinals were created sometime in mid-February 2023 by Casey Rodarmor. It existed as a small, harmless program called ord, which you could download from Github and inscribe various kinds of data into the blockchain.

Ordinals were revolutionary – it gave people a way to inscribe any kind of content and assign it an ownership in their name or in someone else’s – two things that were not possible by using existing data schemes like OP_RETURN.

However, like most other novel projects, people managed to put two and two together, with a thought process that went something like this:

Developer #2 is very bored from working on an altcoin called FOOLS and is about to sign out of the office for the day when Developer #1 rushes in.

Developer #1: Hey, have you heard of this cool new thing called Ordinals?

Developer #2: No, what does it do?

Developer #1: Basically, it inscribes all kinds of stuff into Bitcoin’s blockchain such as images –

Developer #2: (suddenly becoming alert) Wait, did you just say images?

Developer #1: Yeah, it even has an explorer just for viewing inscribed images.

Developer #2: I just had a great idea! If we launch an NFT collection called APRIL FOOLS on these Ordinals, we will make a ton of money.

Developer #1: Jeez. How did I not think of this before?

Developer #1 and Developer #2 proceed to launch an APRIL FOOLS collection on the Bitcoin blockchain, make 10 million dollars, and charter a yacht to Malibu for early retirement.

What a waste of time, just go get a job at Binance.

And so, every NFT project from OpenSea and their grandma came over to Ordinals, hoping to inscribe their collection to make a quick buck.

At this point, there wasn’t much attention from the wider Bitcoin community, except for some sporadic grumbling from some maximalists about how big of a space-waster they are. And for a few months, that was pretty much the norm. Bitcoin was enjoying steadily increasing adoption from the Ordinals program from people who wanted to make a quick buck, and because there weren’t so many Ordinals being created constantly, block space was managible. Life was good.

But it wasn’t long before the thunderstorm would start.

The Rise of BRC-20 Tokens

One of the key limitations of Ordinals is that there is no protocol for it. It is just a fun little program exploiting a loophole in Taproot. But in early March, Twitter user @domodata experimented with a way of converting an ordinal into a realistic Non-Fungible Token (NFT).

As you can see, BRC-20 tokens have no images. They are just a JSON file that describes a token using extremely simple text. They cannot inscribe anything else. At first, almost nobody cared about it. Business went on as usual, apart from a few Ordinals members joining the BRC-20 cult.

Domodata has explicitly warned users that BRC-20 tokens will become worthless. If you don’t believe me, click on the link. It’s really not hard to see that the final resting place of tokens is in the sub-penny price category of exchanges. Interestingly, he also says that Taro is better for creating transferrable assets on Bitcoin, than both BRC-20 and Ordinals. I agree with him on that.

During March and April, BRC-20 tokens would gain an incredible adoption, culminating into a $580 million total market cap by May. Unfortunately, this came at the expense of the rest of the network.

The Rise Of Chaos

You see, when somebody wants to inscribe a file into an ordinal, they have to pay a fee proportional to the size of the ordinal. The reason is so that miners can be interested enough to include it in a block. This is despite it having no financial value. Because BRC-20 is based on Ordinals, it kept the same scheme intact. That means, the same procedure applies for minting tokens.

But instead, everyone was minting their tokens at a fixed fee, and as that fee became untenable, everyone kept increasing the minting fee of their own tokens.

This resulted in a death spiral that has caused average Bitcoin transaction fees to skyrocket from around 20 satoshis per byte to over 500 satoshis per byte at one point. Suddenly, normal people who wanted to make a bitcoin transaction were being charged more than Ethereum. And the mempool became swamped with hundreds of thousands of transactions which were being slowly priced out by BRC-20 tokens.

Understandably, most of the Bitcoin community were furious at this development. These also included some people who supported the Ordinals idea. That is, with the exception of miners, who were obviously happy with snagging fees larger than the block reward. The users though, demanded an immediate end to the nonsense.

Ordinals maximalists, on the other hand, would not have it, and this sparked a conflict similar in nature to some third world countries.

The Bitcoin Civil War

At this point, tensions were culminating left and right between Bitcoin Maximalists and Ordinals Maximalists. All the while, miners were desperately trying to stay neutral to capture the sweet profits like Sylvester the Cat would try to catch a bird. (If only.) But that didn’t stop the occasional youtuber from walking in and warning both sides that just shutting down the Ordinals loophole is such a dumb thing to do because some bloke will just launch it with another hack again. Technically speaking, then it will devolve in to a Hollywood-pirate battle or an antivirus-malware battle. Not ideal for the big guys.

All the while, the war broke out in various parts of the internet:

- Bitcointalk

- and even the bitcoin-dev mailing list.

Ordinals Maximalists wanted maximum freedom for using Ordinals and tokens on Bitcoin without interference. Meanwhile, the Bitcoin Maximalists just wanted everything to go back to normal.

Most celebrities have no idea about any of this and continue to advocate for Bitcoin usage as any sane person should be during a time like this.

“Squad of JSOC guys” meet “one-man insurgent”

If you got the first reference, good job. We’re on the same team. If not, don’t worry – the acronym is just as nonsensical as BRC-20.

So this is the part of the story where your man comes in. I had a bunch of transactions which got stuck because of the fees mania. So naturally, I did what most other sensible people would do about it: scream at everyone else.

Yes, if you’ve managed to read up to here, then you’re probably guilty of this too. Don’t feel bad about it. But then again, you don’t want to go out starting an insurgency by yourself, right?

Now of course it is foolish to try to attempt a huge change on your own, so this one-man insurgency instinctively realizes that the best place to go to garner support is the Bitcoin mailing list. Virtually the entire Bitcointalk forum is already on your side of the battle.

So carefully he chooses his weapon – a fine metallic pad with plasma blast capability – and he fires it at a desolate area of the headquarters near to the place a document with the names of three legendary Bitcoin developers written on it. And it just so happened – there was the controller of the mothership for BRC-20 located exactly at that spot. And then, kaboom! The controller explodes, and the BRC-20 mothership bursts into flames. All Bitcoin developers stand up and applaud.

Or at least, that’s the version of the events that happened according to the mailing list. If you go on Twitter, or read most crypto news websites, they have a slightly different headline.

Old Man Yells At Cloud

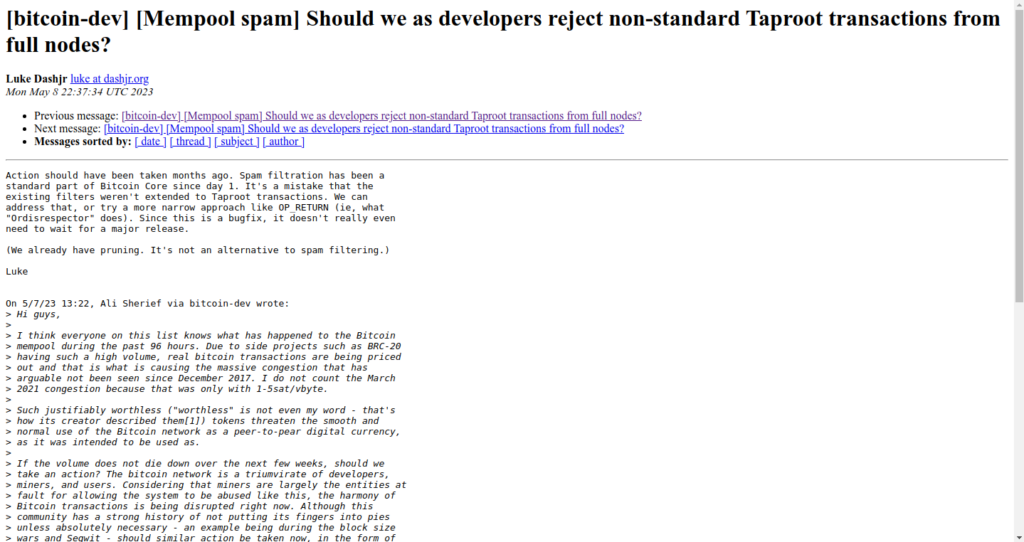

In some of these stories, like this one (and this one) , they accuse Bitcoin developer Luke Dashjr of being the leader of said movement to take down the BRC-20 protocol. In other words, all Bitcoin developers agree with killing Ordinals because Dashjr said so. And most provide the following email-in-tweet as evidence:

However, let’s see what happens when you see the full email:

Oh look, there’s your fellow insurgent.

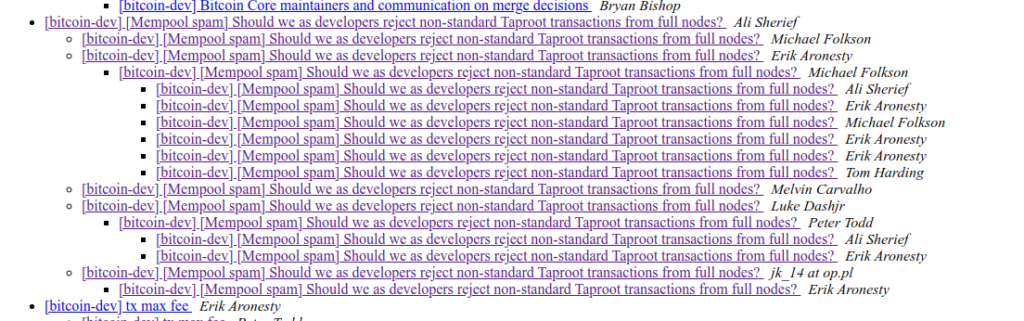

Now let’s see what happens when you organize this by thread:

OK, so you can see that there’s about five or six people who more or less acknowledge that there’s a problem with the current way the network is handling these tokens.

It would be nice for most outside people to come to this conclusion too, but it seems that every time someone like dashjr chimes in, the internet becomes like this:

So yeah. (Almost) nobody cares about the real problem.

How are we going to mitigate the scalability problem?

It is becoming more and more blatant with each passing day that Bitcoin will not and should not solely have a 1 megabyte Layer 1 highway for all user vehicles to use (transact) on, but unfortunately we are not seeing enough effort from developers and companies in attempting to create layer 2 protocols that are immune to layer 1 throttling.

For some reason, everyone is hanging around on Twitter, even after Elon Musk bought the platform and ran it to the ground. Like, what is the purpose of loitering here? There are so many unfinished ideas and proposals that need to be implemented, and crucially, none of them depend on Bitcoin Core developers’ grace or blessings.

Now let’s look at a list of things we should and should not be doing:

- Should the Bitcoin Developers choke the Taproot loophole that Ordinals uses? No, it’s too late for that as we don’t want to cause many people to lose their money simultaneously. One thing I agree with Luke’s email is: we should’ve done that 4 months ago. Now the window for it has passed.

- Should we patch our own nodes to filter out Ordinals using something like Ordisrespector? Yes, if you want. Everybody has the freedom to run their own nodes with whatever code they like.

- Should developers do… nothing? No. Then this situation will repeat itself another time. And we wouldn’t have learned anything from it.

- Should developers make a solution for this problem on Layer 1? Yes, if that works. But the only real scalability fix available is

increase blocksizeand you can only do that so many times. - Should developers make a solution for this problem on Layer 2? Yes, as long as devs manage to get most people to use Layer 2. It doesn’t necessarily have to be a new protocol but it could just be creating software that uses them.

- Should bitcoin users make transactions even with high fees? Yes, otherwise the Bitcoin network will effectively freeze.

- Should miners stop including Ordinals in their transactions? No, this will cut off a lot of their revenue and make the pools lose hashpower to rivals.

- Should everyone combat FUD spread about both Bitcoin and Ordinals on the internet? Of course. It is in everyone’s best interest to know the facts.

- Should we spread FUD about Bitcoin or Ordinals hoping it will get people to side with us? No, what the heck are you thinking. That’ll just make people think of you as a douchebag.

So, I think that wraps up a dramatic few days. I myself am going to create a Lightning wallet due to the chronic shortage of Lightning Network wallets for desktop. Electrum has a Lightning client that’s half-functional. But that’s a rant for another day. This is Ali Sherief, signing out.