The Bitcoin block size limit is a parameter in the bitcoin protocol that determines the size of bitcoin blocks. The average time required to create each block is 10 minutes and its size is 1 MB. Bitcoin blocks contain a file in which the data pertaining to new transactions in the bitcoin network is recorded. This data is recorded on a regular basis. Each of these blocks belongs to a ledger and can create a decentralized ledger by chaining together.

What is the Bitcoin Block Size Limit?

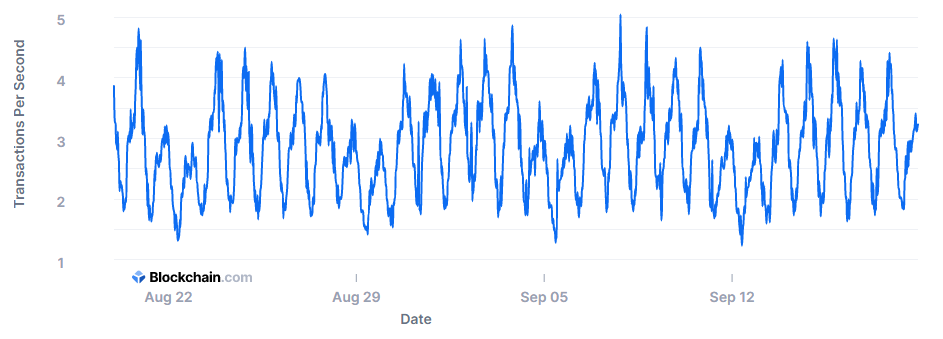

This parameter in the Bitcoin protocol means that it will limit the number of transactions that are approved by each block. By limiting bitcoin block size, the resulting number of transactions is affected. In fact, the size of a block limits the number of transactions that the Bitcoin network can process per second (pictured below). But when the blocks are filled, the bitcoin network becomes crowded, in which case the cost of transactions increases dramatically.

Bitcoin Block Size Limit Changes

In 2013, the size of each block was approximately 125 KB. In 2015, the block size was changed to 425 KB due to the increase in transactions and acceptance of Bitcoin by the public. Today, the size of each bitcoin block is in the range of 1 MB. You can also see the Bitcoin block size changes in the image below.

What was the reason for the Bitcoin block size limit?

Satoshi Nakamoto has never stated the reason for this restriction, but there is a lot of speculation about it. Satoshi Nakamoto withdrew from the development of Bitcoin, and yet there was much debate among developers about the temporality and necessity of the block size limit. However, the removal of this restriction would lead to spam on the network by creating malicious transactions on the network.

Consequences of reducing Bitcoin block size?

Reducing the Bitcoin block size limit means that due to this volume of transactions per day and increasing transactions, many transactions can no longer be processed by the Bitcoin network. As a result, there is not enough space to place transactions in these blocks, and the cost of transactions will increase dramatically. So the Bitcoin system and the free attitude we had from it will change drastically and only large companies and banks will trade with each other in this network.

What does this ultimately cause?

People leaving the world of Bitcoin. Definitely, no one prefers very small blocks that take a lot of fee and time from the user. As a result, people are leaving Bitcoin, which in turn leads to other digital currencies that will have fewer restrictions.

What are the Consequences of increasing Bitcoin block size?

Bitcoin Cash is one of the hard-forks of Bitcoin that increases the maximum block size. On 1 August 2017, the Bitcoin blockchain was split into two parts and Bitcoin Cash was separated from bitcoin. The cost of operating a Bitcoin node is one of the disadvantages of large blocks. So increase the of these blocks size, make full nodes more expensive. As a result, blockchain storage costs, bandwidth costs, and CPU costs (which process all transactions and blocks) increased. Another disadvantage is the creation of a centralized mining system, which causes smaller miners to leave. More reorgs and double-spends due to slower propagation speeds is another reason for opponents of increasing Bitcoin block size.

In the end, what is clear is the disagreement between the developers, and yet no one alone could change the size of the 1 MB block, because bitcoin is decentralized. In other words, increasing or decreasing the size of the Bitcoin block size limit is not in the hands of a specific group or individual.